Humanity’s Last Exam is a new measure of Artificial Intelligence that has been developed since various AIs have blown away all previous measures. The idea is to take cutting edge problems from many areas of study with definite answers to measure AI progress. In the last year, AI has gone from answering 10% of these to over 50%.… read more “Humanity’s Last Exam”

New racism

Just as two wrongs don’t make a right, new racism does not make up for old racism; it creates fresh wounds in the next generation of people.

Slaughtering three pigs

AI is a lethal threat to us this year

Improvements in artificial intelligence have reached the takeoff point and are increasing exponentially. AI has already exceeded human intelligence by most measures. This year, we will see it far exceed human capabilities. The problem is that we are basically birthing a new form of life, one that will not care about human wants or needs. Most people who have studied this issue (see the book “Superintelligence: Paths, Dangers, Strategies” by Nick Bostrom) believe there is a much higher than 50% chance that this ends in the extinction of our species even IF artificial intelligence was developed slowly and under strict controls.… read more “AI is a lethal threat to us this year”

Inside the World’s Most Unconventional Prison | El Salvador Prisons

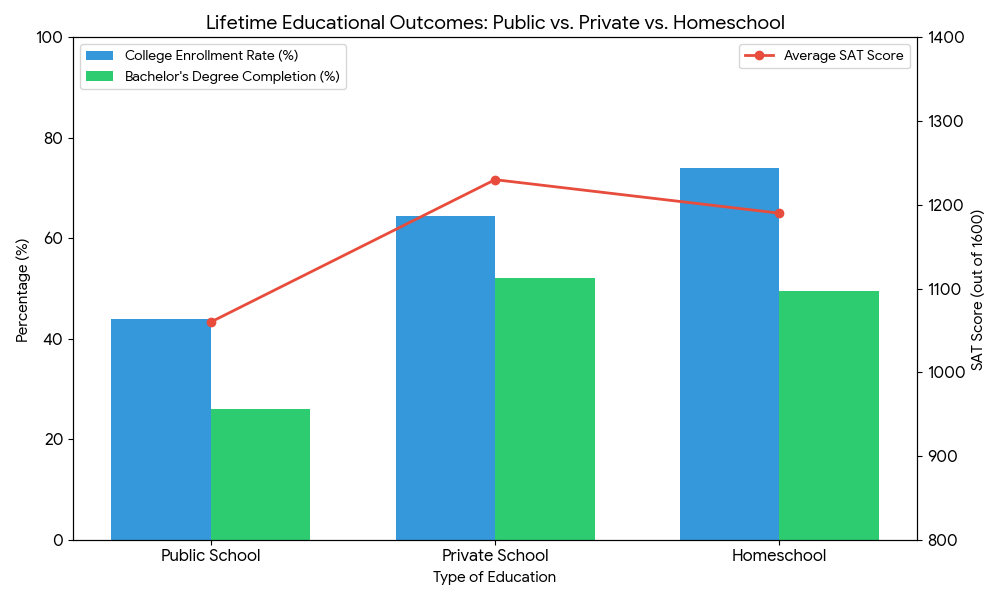

Public vs Private vs Homeschool Outcomes for Students

Research consistently indicates that students from private and homeschool backgrounds often achieve higher academic and long-term life outcomes compared to their public school counterparts.

Private Schools: A long-term study by the National Center for Education Statistics (NCES) found that students who attended private school in 8th grade were twice as likely to have completed a bachelor’s degree by their mid-20s compared to public school students (52% vs.… read more “Public vs Private vs Homeschool Outcomes for Students”

Bernie and I finally agree

Bernie Sanders and I have never agreed before, but I agree with him strongly that we need to stop the AI rush. https://www.theguardian.com/us-news/2026/feb/21/ai-revolution-bernie-sanders-warning

Read “Superintelligence”, this is most likely not going to end well for our species.

Democracy fails without trust

Democracy will fail without elections everyone can trust. Each citizen should get only one vote and no one who is dead, a criminal, or not a citizen should get a vote. Elections should be transparent and easy to check that. This is why the SAVE Act is so important to have passed – it requires photo ID, just like buying a beer or getting a job.

I Love America

I grew up poor, started a business, and slowly built up wealth. This is the basic logic of America: you get rich by making things people want. If you solve problems for others or make things cheaper, you create riches. It is a simple, honest machine that works for anyone. The only way to break it is to let socialist or fascist central planners take over.… read more “I Love America”

Farm Dump Truck Disaster