Month: June 2013

EDD Claim – Hall of Shame

A copy editor quit of her own volition and tried to claim unemployment. Supposedly we “were training a summer intern to replace her”. Retarded idea… You can’t replace a full time employee with a summer intern. We even told her she could move up if she got her work on track. Ugh.

Forgotten Billing – Hall of Shame

My CFO and a Digital Producer did not invoice a major client for three months while we have done tons of work. CFO did not apologize, instead had lots of reasons why it was other peoples fault.

Urethra to Kidney Stone…

Intern Made This For Our Team…

Little Brother Visiting This Summer…

Josh Says Joel is Eye of Sauron

Plan For a Better Life: Business Cheat Sheets

Download the Better Life Plan Cheat Sheet PDF here.

-

General health

-

Life is a wonderful, amazing and rare gift. Maximize your enjoyment of it by taking care of your body. You take care of your body now, it will take care of you as you get old.

-

Never smoke, avoid drinking more than 3 glasses of wine in a week (and no more than 2 in a sitting), never take prescription or illegal drugs.

-

How To Get Free Labor – Business Cheat Sheets

In my time as CEO of Coalition, I have worked with dozens of business owners and have seen what makes a business owner successful and what makes others fail. The single biggest distinguishing factor I have observed is NOT intelligence or connections. Instead, the single biggest factor that determines the success or failure of a new business is the amount of work the business owner himself puts into the company.… read more “How To Get Free Labor – Business Cheat Sheets”

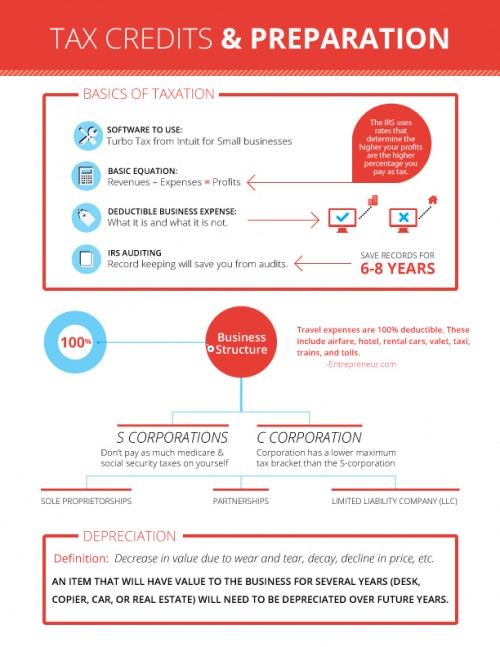

Business Tax Credits and Tax Preparation: Business Cheat Sheets

Download the PDF of the tax credits and preparation cheat sheet here.

Taxes are an inevitable part of life for the successful business owner. Once your company is built and operational and bringing profits, Uncle Sam is going to come knocking at your door to take his share. You want to make sure you pay all of the taxes you are legally obligated to or you will find yourself in prison or paying huge fees at a high interest.… read more “Business Tax Credits and Tax Preparation: Business Cheat Sheets”